weekly gamma Analysis

10/23/2023

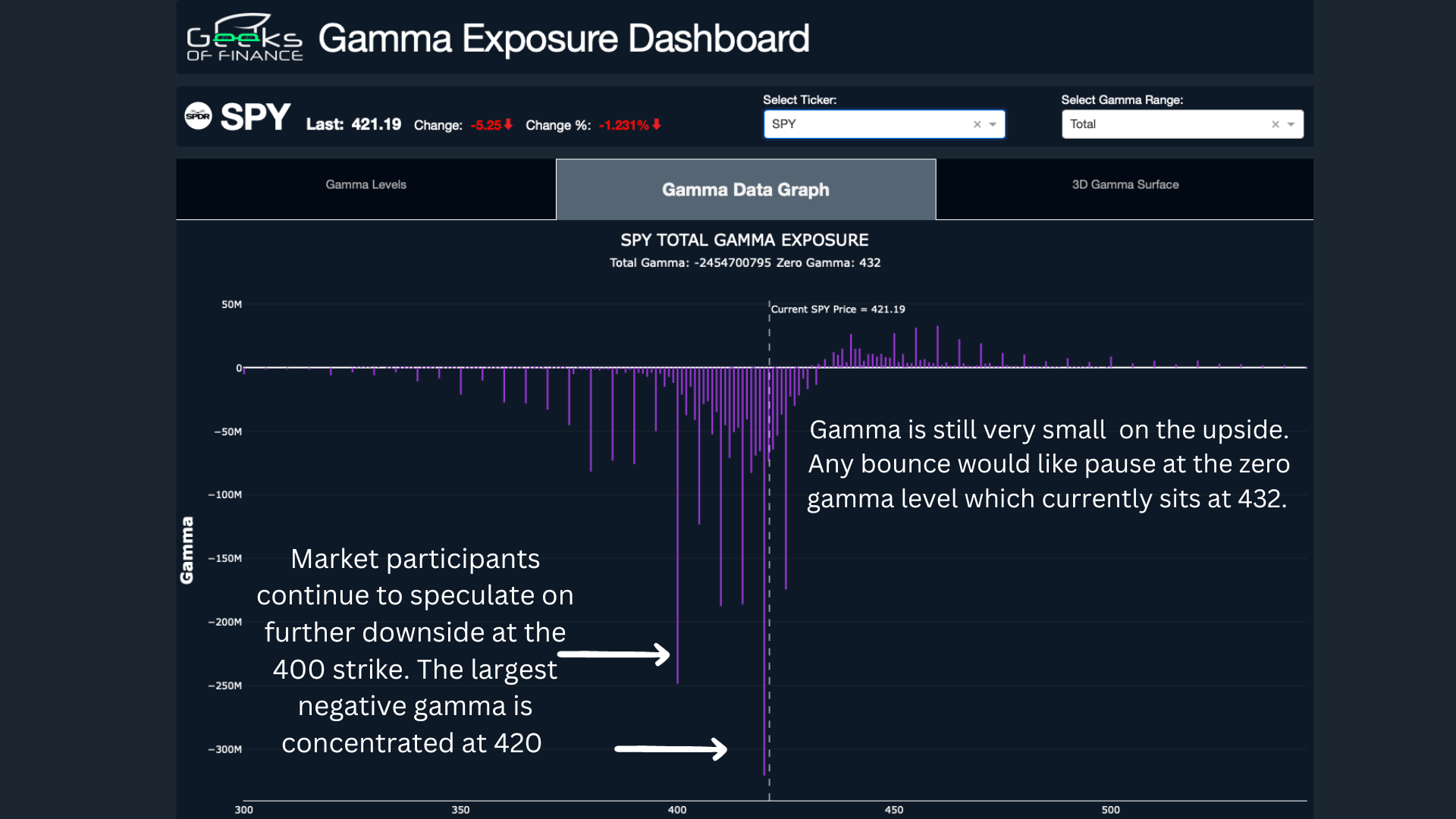

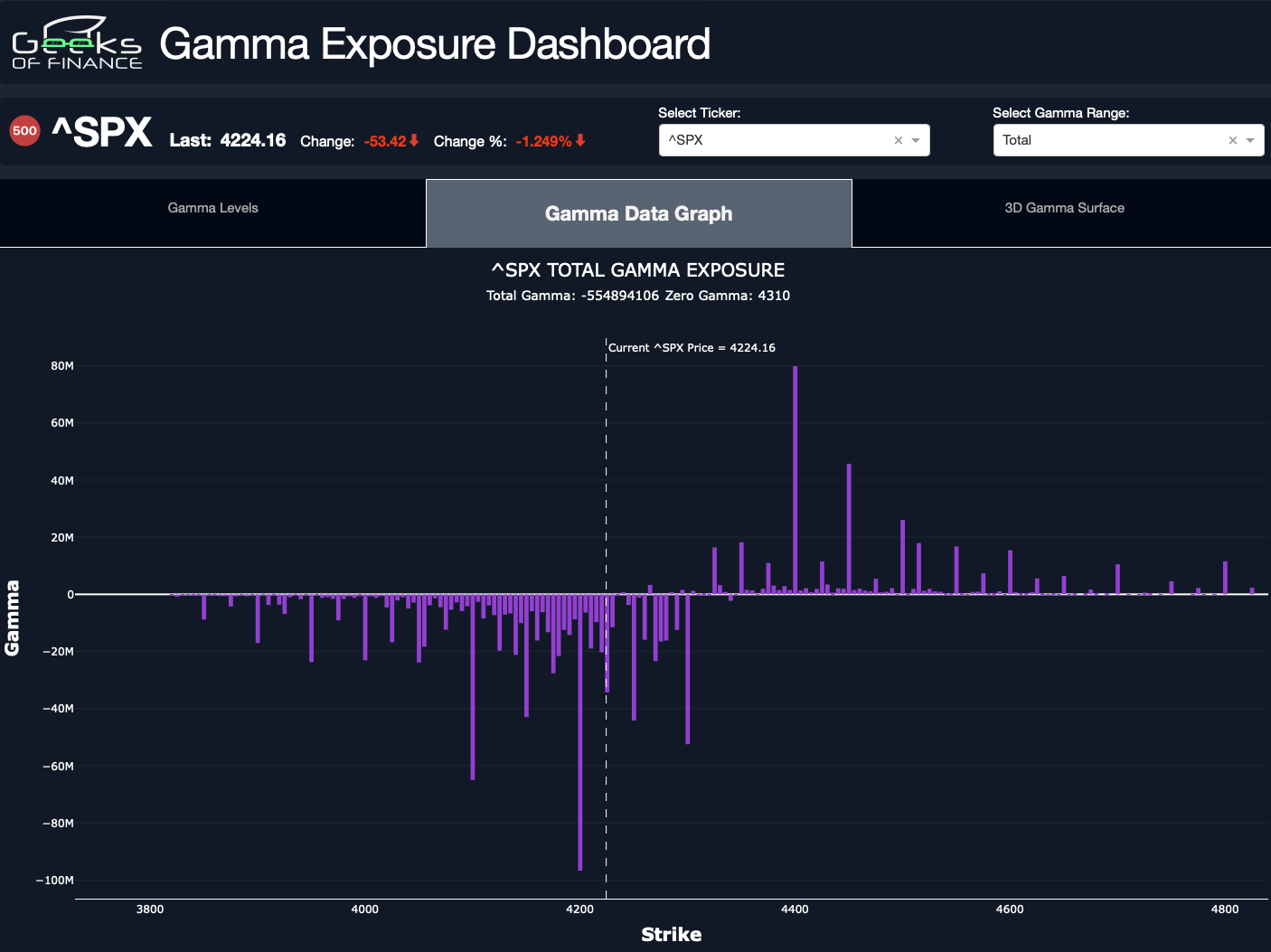

We ended OpEx week with the markets continuing their selloff towards the big gamma concentration levels of 4200/420 on SPX and SPY. Although the first half of October saw a couple of bounces, negative gamma was the predominant force in the market, ultimately winning out and sending the major indices tumbling lower.

This week is starting off with continued negative gamma across the major indices and index ETFs. Although we typically see the indices trading near their zero gamma levels following big monthly or weekly expirations, this week is fairly deep in negative gamma territory, which is not surprising considering the current market environment.

We have a number of potential catalysts coming up which could further spike volatility (both to the upside and downside) including PMI, GDP, PCE and Durable Goods data, as well as peak earnings season. Definitely a time to stay vigilant on the trading front.

The VIX solidly broke above its zero gamma range last week and is fast approaching our target in the 25-28 zone. On the SPY, gamma is heavily concentrated around the 420 strike, so a confirmed break below that level and we could quickly see the 400 strike come in to play as gamma continues to grow there. SPX is not quite as bearish yet, with the 4200 and 4100 strikes the primary levels we’re watching this week.